Media Lounge's eCommerce Lockdown Report

As lockdown begins to ease across the UK, we thought it would be the perfect time to review the performance of Media Lounge’s key clients, to look at their performance on both a year on year (YoY) basis and their recent performance compared to the period just before lockdown.

Lockdown was harsh in many ways, but it was kind with its timing – for the purpose of this review, we have been able to look at Q1 2020 as being ‘pre-lockdown’ and Q2 as being ‘actual lockdown’. This tees us up nicely to revisit this study in a few months based on Q3 performance, which will become the ‘post-lockdown’ period.

The study includes a range of businesses from startups to established, in both the B2B and B2C spaces. All businesses are using Magento 1 or 2 and cover a range of verticals including food and drink, fashion, gaming, electronics, sporting goods, building & DIY and home & garden.

Conversion Rates

Across the board, conversion rates saw a fairly considerable rise as we went into lockdown, which reflects the need to shop online. This mirrored the Q1 to Q2 rise seen in 2019, but it started higher in Q1 2020 and as it stands the trend is set to further increase in Q3.

As somewhat expected with more consumers online and fewer people going to work, B2C conversion rates outperformed B2B conversion rates during lockdown. From Q1 2020 to Q2 2020, B2C clients saw a 17% increase in their conversion rate compared to a 1% decrease for our B2B clients. So B2C was the clear winner here, but it will be interesting to see how B2B performs in terms of conversion rates in the post lockdown period as businesses begin to return to normal and purchasing habits change.

Looking at Q2 YoY performance, both B2C and B2B clients saw an increase thanks to lockdown. Again B2C clients came out on top with a huge 37% increase in conversion YoY against a 2% YoY increase for B2B clients. It’s worth keeping in mind that these statistics take into account all of our B2B clients, some of which saw massive drops in conversion rates thanks to full industry shutdowns considerably affecting their businesses.

Revenue

On average, client revenue increased by a huge 77% across the board from Q1 2020 to Q2 2020 thanks to lockdown. This rapid shift to online purchasing can clearly be seen in the graph above. The year on year comparison paints an even better picture with a massive 98% increase, taking total Q2 revenue to over £65 million which equates to an average of more than £2 million per client.

Looking at the split, both B2B and B2C clients have seen huge revenue growth thanks to lockdown, despite poor performances in certain areas. B2B saw an increase of 66% between Q1 and Q2 and B2C saw an increase of 79% for the same period.

Turning our attention to the year on year comparisons, B2C clearly comes out on top with a 101% increase in Q2 YoY compared to a 46% increase in Q2 YoY from B2B clients. Both are impressive annual increases that most businesses would take in a snap!

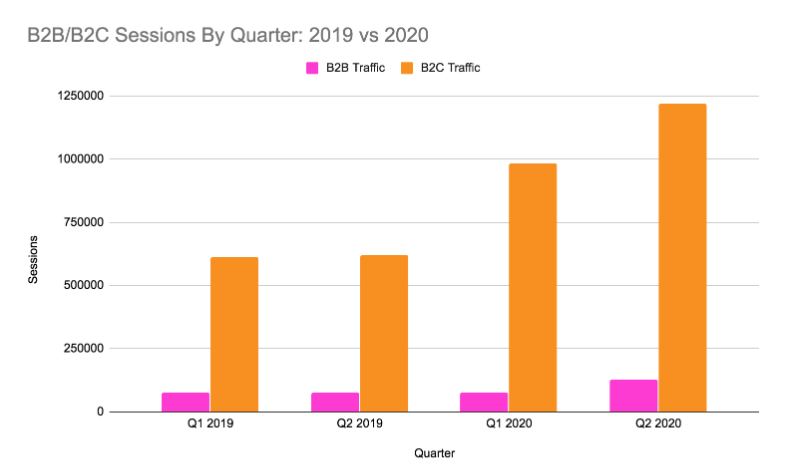

Sessions

The graph above looks at sessions over the same periods. There was a small increase in B2B sessions but that looked fairly small in comparison to the increase in traffic seen on our B2C sites. Shops were closed, people were at home and many had extra time for online browsing due to being furloughed. These elements combined will have all driven the 96.4% B2C rise over the lockdown period when compared to the previous year.

While some industries have been decimated and remain in a state of limbo, eCommerce has gone from strength to strength. What’s even more exciting is any newly acquired customers are likely to stick around long after the high street has reopened.

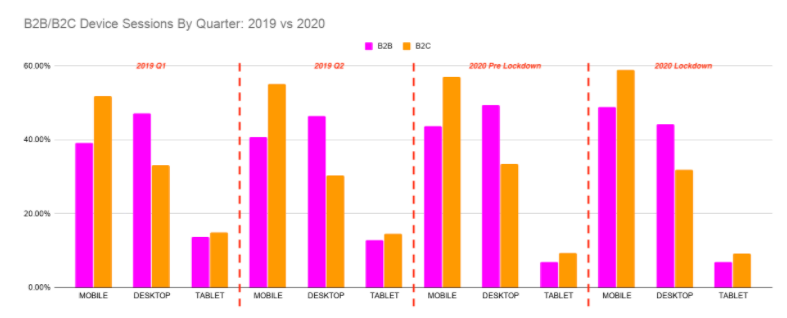

Device Usage

The shift to mobile devices has been happening for some time now and the lockdown period has seen this continue. This feels natural on the B2C side, but less so on the B2B front. However, it was the lockdown period that finally saw mobile overtake desktop usage in the B2B world, probably driven by computers remaining in the office while employees worked from home. The rise of mobile has not come 100% at the expense of desktop usage; we see tablet usage down 42%, to represent just 8.36% in the lockdown period.

Who Won And What Next?

So it’s clear that, with some exceptions, lockdown has been very favourable indeed to eCommerce businesses.

Home and garden did very well alongside building and DIY related stores. Food and drink also performed well, as naturally this helped bypass unnecessary trips to the supermarket. Gaming saw a massive rise with customers looking for an instant fix to keep the boredom away. Fashion fared less well initially, but with the high streets remaining fairly uninviting into Q3 we could yet see it rise in line with other sectors.

Lockdown has not come without its challenges, as all businesses have had to conform with the new rules and regulations around social distancing and safe operation. With much of that now understood and in place, our clients and similar businesses are ready to take their 2020 performance to the next level, post lockdown. The B2C sector is a clear winner, but it’s very possible that B2B is a sleeping giant here, and their time to fully shine will come later in the year – tune in next quarter for the post-lockdown review to see how things have evolved!

Need Help?

Get in touch with the Media Lounge team if you want to help to improve your post-coronavirus eCommerce sales metrics from a team proven to deliver results!